Page 1: Cover Page

[PayNova Systems Logo]Title:

Beyond Banking: The Fintech Revolution Reshaping Global Finance

Subtitle:

An In-Depth Industry Report on Digital Banking Infrastructure, Market Trends, and Investor Opportunities

Author:

PayNova Systems

Date:

October 26, 2023

Page 2: Executive Summary & Table of Contents

Executive Summary

The global financial landscape is undergoing a seismic shift. Traditional banking, constrained by legacy infrastructure, is struggling to meet the demands of a digitally-native consumer base and the rapid pace of innovation. This creates a monumental challenge for incumbents and a significant opportunity for agile players. The rise of Banking-as-a-Service (BaaS) and embedded finance is not just a trend; it’s the new competitive frontier, projected to become a $7 trillion market by 2030.

This whitepaper dissects this transformation, outlining the core problems facing financial institutions and the non-financial brands seeking to enter the market. It highlights how modern, API-first digital banking infrastructure is the critical enabler for this revolution.

- The Problem: Legacy core banking systems are monolithic, expensive to maintain, and slow to adapt. They hinder innovation, prevent seamless integration with third-party services, and create significant operational overhead, costing the industry billions annually in lost opportunities and maintenance.

- The Opportunity: The shift towards Open Banking, embedded finance, and niche digital services has created an urgent need for a flexible, scalable, and compliant infrastructure layer. Companies that provide this foundation are positioned to capture immense value by powering the next generation of financial products.

- The Solution: PayNova Systems offers a cloud-native, API-driven banking infrastructure platform. Our modular architecture allows banks, fintechs, and enterprises to rapidly build, launch, and scale financial products—from digital bank accounts and payment processing to card issuing and lending—without the burden of building from the ground up. We reduce time-to-market by up to 80% and lower the total cost of ownership (TCO) by over 50%.

This report serves as a guide for executives, investors, and innovators looking to understand and capitalize on the forces reshaping finance.

Table of Contents

- Cover Page

- Executive Summary & Table of Contents

- Introduction

- Market Landscape: The Unbundling of Banking

- Problem Definition: The Legacy Infrastructure Bottleneck

- Solution Overview: The PayNova Nexus Platform

- Technical Architecture: Built for the Future of Finance

- Business Model & Value Proposition

- Use Cases: Powering Financial Innovation

- Regulatory & Compliance Considerations

- Conclusion & Call to Action

- References

Page 3: Introduction & Market Landscape

Introduction

For decades, the banking industry operated on a foundation of vertically integrated, closed systems. Today, that foundation is cracking under the pressure of digital disruption. Consumers expect seamless, embedded, and personalized financial experiences, akin to what they receive from tech giants like Amazon and Netflix. This demand has fueled a fintech explosion, creating a new ecosystem of specialized providers.

The key challenge, however, is not a lack of innovative ideas but a lack of modern infrastructure to support them. Traditional banks are tethered to legacy core systems that are often decades old, making it nearly impossible to innovate at speed. This technological debt creates a critical market opportunity for a new kind of company: the digital banking infrastructure provider.

This paper explores the tectonic shifts in the financial industry and introduces the PayNova Nexus Platform, a modular, API-first infrastructure designed to empower any company to become a fintech company.

Market Landscape: The Unbundling of Banking

The traditional banking model is being unbundled, with specialized fintech players targeting every component of the value chain. This is driven by several key trends:

- Banking-as-a-Service (BaaS): BaaS providers offer API-based access to core banking functions (like accounts, payments, and lending), allowing non-banks to embed financial services into their products. The global BaaS market is projected to reach $74.5 billion by 2031, growing at a CAGR of 17.1% (Allied Market Research, 2022).

- Embedded Finance: This is the seamless integration of financial services into non-financial platforms. Examples include “Buy Now, Pay Later” (BNPL) at e-commerce checkout or in-app insurance for travel bookings. According to Lightyear Capital, embedded finance will generate over $230 billion in revenue by 2025.

- Open Banking & Regulatory Tailwinds: Regulations like PSD2 in Europe and the Consumer Data Right (CDR) in Australia mandate that banks share customer data (with consent) via secure APIs. This has forced the industry towards open, interconnected ecosystems, creating fertile ground for innovation.

- Rise of Niche Neobanks: Digital-only banks are capturing market share by focusing on underserved segments (e.g., freelancers, SMBs, specific demographics). Their success is predicated on a low-cost, agile technology stack, a feat unachievable with legacy systems.

These trends illustrate a clear gap: the demand for modern financial products is outpacing the supply of underlying infrastructure capable of delivering them.

Page 4: Problem Definition & Solution Overview

Problem Definition: The Legacy Infrastructure Bottleneck

The primary barrier to innovation in finance is not vision, but technology. Legacy core banking systems, often built on COBOL mainframes, create a cascade of business-critical problems:

- Prohibitive Costs: A recent McKinsey report (2022) estimates that large banks spend 70-80% of their IT budgets simply maintaining existing legacy systems, leaving little room for innovation.

- Slow Time-to-Market: Launching a new product on a legacy core can take 12-18 months and millions of dollars due to complex, manual coding and extensive testing. In the digital age, this is a fatal disadvantage.

- Data Silos & Lack of Integration: Monolithic architecture makes it incredibly difficult to integrate with modern third-party applications or to get a unified view of the customer. This prevents personalization and cripples efforts to leverage data analytics and AI.

- Scalability and Resilience Issues: These systems were not designed for the high-volume, real-time transaction demands of a digital-first world, leading to performance bottlenecks and system failures.

- Compliance & Security Risks: Patching old systems to meet new regulatory requirements (e.g., AML, data privacy) is complex and fraught with risk, exposing institutions to hefty fines and reputational damage.

For non-financial companies, the barrier is even higher. Building a financial product from scratch requires navigating immense regulatory complexity and a multi-year, multi-million dollar technology build-out—a non-starter for most.

Solution Overview: The PayNova Nexus Platform

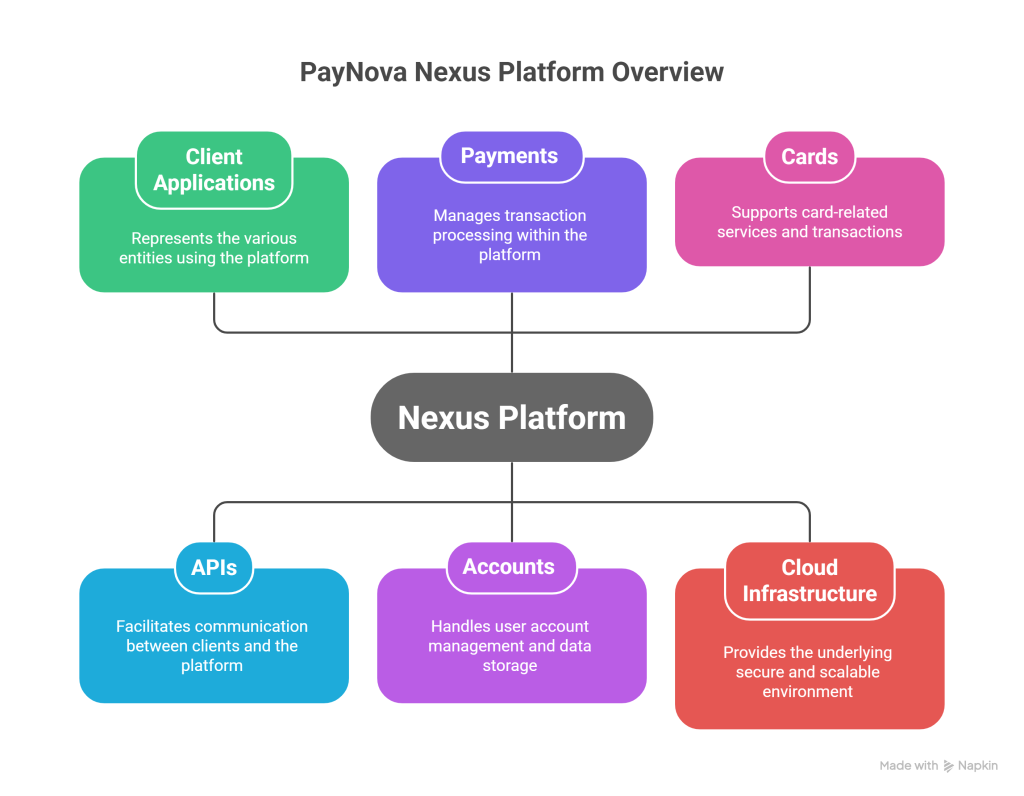

PayNova Systems addresses this fundamental bottleneck with the PayNova Nexus Platform—a comprehensive, cloud-native, and API-first banking infrastructure. Our platform acts as a “financial operating system,” enabling clients to embed financial capabilities directly into their products with speed, security, and scalability.

Nexus is built on a modular, microservices architecture. Clients can choose the specific capabilities they need and assemble them like building blocks.

Key Platform Modules:

- Core Banking Ledger: A real-time, double-entry ledger for managing accounts, balances, and transactions.

- Payments Gateway API: Orchestrates domestic and cross-border payments through various rails (ACH, FedWire, SEPA, SWIFT).

- KYC/AML Engine: Automates identity verification and transaction monitoring to ensure regulatory compliance.

- Card Issuing & Processing: APIs to create, manage, and process virtual and physical debit and credit cards.

- Lending Core: A flexible engine to configure, launch, and service loan products.

By providing this foundational layer, PayNova empowers its clients to focus on what they do best: creating exceptional customer experiences.

Page 5: Technical Architecture & Business Model

Technical Architecture: Built for the Future of Finance

The PayNova Nexus Platform is engineered for resilience, security, and developer-friendliness. Our architecture is designed to meet the rigorous demands of financial services while providing the flexibility modern development teams expect.

- Cloud-Native Foundation: Deployed on leading cloud providers (AWS, Azure, GCP), ensuring global scalability, high availability (99.99% uptime), and disaster recovery.

- Microservices Architecture: Each core function (e.g., payments, ledger) is an independent, containerized microservice. This allows for rapid, independent updates and prevents a single point of failure.

- API-First Design: All platform functionality is exposed through well-documented, RESTful APIs. This simplifies integration and empowers developers to build rich applications on top of our infrastructure.

- Security & Compliance by Design:

- Certifications: SOC 2 Type II compliant and PCI-DSS Level 1 certified.

- Data Privacy: Built-in compliance with GDPR, CCPA, and other regional data protection regulations.

- Encryption: End-to-end encryption for data in transit (TLS 1.2+) and at rest (AES-256).

- Access Control: Granular, role-based access control (RBAC) and mandatory multi-factor authentication (MFA).

Business Model & Value Proposition

PayNova operates on a transparent, partnership-oriented business model designed to align our success with our clients’.

- Revenue Model: A hybrid SaaS model consisting of:

- Platform Fee: A recurring monthly subscription fee for access to the Nexus Platform and its core modules.

- Usage-Based Fees: Transactional fees based on API calls, active accounts, or payment volume. This allows clients to scale costs with their growth.

- Target Customer Personas:

- The Incumbent Bank: Seeking to modernize its core, launch a digital-only brand, or quickly roll out new products without disrupting its legacy systems.

- The Fintech Startup: Needing a compliant and scalable backend to get to market quickly and affordably.

- The Enterprise Brand: A non-financial company (e.g., retail, logistics, SaaS) looking to embed financial services to increase customer loyalty and open new revenue streams.

Value Proposition & ROI:

- Cost Savings: Reduce Total Cost of Ownership (TCO) by over 50% compared to building and maintaining an in-house legacy system.

- Speed to Market: Launch new financial products in weeks, not years—a reduction of over 80%.

- Revenue Growth: Unlock new revenue by offering embedded financial services like lending, payments, and branded bank accounts.

- Risk Reduction: Mitigate compliance and security risks with our pre-built, continuously updated regulatory and security frameworks.

Page 6: Use Cases & Conclusion

Use Cases: Powering Financial Innovation

Use Case: A Regional Bank Launches a Digital Neobank

- Client: A mid-sized regional bank with an aging infrastructure.

- Challenge: The bank wanted to attract a younger demographic but couldn’t build a modern mobile banking experience on its current core.

- Solution: Using PayNova Nexus, the bank launched a separate, digital-only brand in under four months. They utilized our Account Ledger, KYC Engine, and Card Issuing APIs to offer a seamless mobile onboarding and banking experience, without a costly and risky core system migration.

Use Case: An E-commerce Platform Embeds Lending

- Client: A large online marketplace for home goods.

- Challenge: The client wanted to offer point-of-sale financing (“Buy Now, Pay Later”) to increase conversion rates and average order value.

- Solution: The marketplace integrated PayNova’s Lending Core API directly into its checkout flow. This allowed them to offer instant financing decisions and installment plans, powered by PayNova’s infrastructure, boosting sales by 15%.

Regulatory & Compliance Considerations

PayNova Systems understands that trust is the currency of finance. Our platform is built with a compliance-first mindset.

- AML/KYC: Our integrated engine supports global identity verification standards and provides robust transaction monitoring and reporting tools to help clients meet their anti-money laundering obligations.

- Data Privacy: We are fully compliant with GDPR and other major data privacy laws, providing clients with the tools and assurances they need to manage customer data responsibly.

- Licensing Support: While PayNova is not a bank, our platform is designed to operate within complex regulatory frameworks. We partner with sponsor banks to enable non-licensed clients to offer regulated financial products legally and efficiently.

Conclusion & Call to Action

The future of finance is not about building bigger banks; it’s about making financial services more accessible, intelligent, and embedded in our daily lives. This future will be built on a new generation of digital infrastructure—one that is open, scalable, and secure. Legacy technology is no longer just a cost center; it is an existential threat to institutions that fail to adapt.

PayNova Systems provides the foundational platform to not only survive this transition but to lead it. Our Nexus Platform de-risks innovation, accelerates growth, and unlocks the vast potential of embedded finance.

Are you ready to build the future of finance?

- Schedule a personalized demo to see the PayNova Nexus Platform in action.

- Contact our sales team to discuss a pilot program for your organization.

- Visit us at www.paynovasystems.com to download our API documentation.

References

- Allied Market Research. (2022). Banking as a Service (BaaS) Market Outlook – 2031.

- McKinsey & Company. (2022). The great unwiring: How to manage the technology risks of divestitures.

- Lightyear Capital. (2021). The $230 Billion Embedded Finance Opportunity.

- Boston Consulting Group (BCG). (2023). Global Fintech Report 2023.