Page 1: Cover Page

[Summit Wealth Advisors Logo]Title: Navigating Inflation: A Data-Backed Framework for Long-Term Portfolio Stability in the U.K.

Subtitle: Protecting and Growing Wealth in a New Economic Era

Author: Summit Wealth Advisors

Date: October 2023

Page 2: Executive Summary & Table of Contents

Executive Summary

The United Kingdom is navigating its most significant inflationary period in four decades. This economic shift has fundamentally challenged traditional investment strategies, particularly the balanced 60/40 portfolio, which has seen its core diversification principles falter as both equities and bonds have declined in tandem. For high-net-worth individuals, family offices, and institutional investors, this environment poses a material threat to the long-term preservation of purchasing power and wealth. The “buy and hold” strategies of the past are no longer sufficient to secure financial futures.

Summit Wealth Advisors has developed the Dynamic Inflation-Resilient (DIR) Framework, a sophisticated, data-driven methodology designed to address this challenge directly. Our approach moves beyond static asset allocation to actively manage portfolios in response to evolving macroeconomic signals.

This whitepaper will:

- Define the Problem: Detail how persistent U.K. inflation and rising interest rates are systematically eroding portfolio values and invalidating traditional investment models.

- Present the Landscape: Provide a data-backed analysis of the current U.K. market, highlighting the structural changes that necessitate a new strategic approach.

- Introduce Our Solution: Outline the core pillars of our DIR Framework, which integrates real assets, inflation-linked securities, quality dividend-growth equities, and alternative strategies to build robust, all-weather portfolios.

- Demonstrate Value: Showcase through specific use cases how our framework protects capital, mitigates volatility, and uncovers unique growth opportunities that are often missed by conventional advisors.

Our objective is to provide investors with a clear, actionable blueprint for achieving portfolio stability and real, long-term growth in an inflationary world.

Table of Contents

- Introduction: The End of an Era for U.K. Investors…………….. Page 3

- Market Landscape: A New Reality for British Capital……………. Page 3

- Problem Definition: The Erosion of the 60/40 Portfolio……… Page 4

- Solution Overview: The Dynamic Inflation-Resilient (DIR) Framework….. Page 4

- Our Analytical Methodology: The Engine Behind the Framework……. Page 5

- Client Value Proposition & Engagement Model……………………… Page 5

- Use Cases: The DIR Framework in Action……………………………….. Page 6

- Conclusion: Building a Resilient Future…………………………………… Page 6

- References…………………………………………………………………………….. Page 6

Page 3: Introduction & Market Landscape

1. Introduction: The End of an Era for U.K. Investors

For over a decade, U.K. investors operated in a predictable environment of low inflation, low interest rates, and accommodative monetary policy. This paradigm rewarded passive, long-only strategies and cemented the 60% equity / 40% bond portfolio as the bedrock of wealth management. However, the confluence of post-pandemic supply chain disruption, geopolitical energy shocks, and shifting fiscal policy has ushered in a new, more challenging era defined by persistent, elevated inflation.

The core challenge is now clear: conventional portfolios are ill-equipped to protect, let alone grow, wealth in real terms. The negative correlation between equities and bonds—the very foundation of diversification—has broken down, exposing investors to unprecedented risk. This paper explores the structural failures of traditional asset allocation in the current climate and introduces the Summit Wealth Advisors’ Dynamic Inflation-Resilient (DIR) Framework—a modern methodology designed to deliver stability and growth in this new economic reality.

2. Market Landscape: A New Reality for British Capital

The current U.K. investment landscape is shaped by several powerful and interlocking trends. Understanding these is critical to appreciating why a strategic shift is no longer optional, but essential.

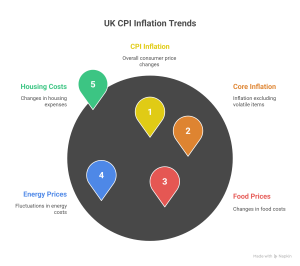

Persistent Inflation: The U.K. Consumer Prices Index (CPI) has remained stubbornly above the Bank of England’s 2% target, peaking at levels not seen since the early 1980s. While moderating, forecasts from the Office for Budget Responsibility (OBR) suggest inflation will remain structurally higher than in the previous decade. This systematically erodes the real value of cash and fixed-income assets.

Aggressive Monetary Tightening: In response, the Bank of England has embarked on its most rapid interest rate hiking cycle in modern history. This has directly impacted bond markets, with U.K. Gilts experiencing significant price declines. The yield on a 10-year Gilt, once near zero, has surged, creating capital losses for existing bondholders and upending risk-free rate calculations.

Correlated Asset Declines: In 2022, both the FTSE 250 and the Bloomberg U.K. Gilt Index posted negative returns. This simultaneous decline dismantled the core premise of the 60/40 portfolio, proving that government bonds can no longer be relied upon as a stable hedge against equity market volatility during an inflationary shock.

Shifting Growth Dynamics: High inflation and borrowing costs are reshaping corporate performance. Companies with strong pricing power, robust balance sheets, and tangible assets (i.e., “quality” and “value” factors) are outperforming high-growth, long-duration technology stocks whose future cash flows are heavily discounted in a high-rate environment. This demands a more discerning approach to equity selection.

Page 4: Problem Definition & Solution Overview

3. Problem Definition: The Erosion of the 60/40 Portfolio

The central problem facing U.K. investors is the structural failure of the traditional balanced portfolio. This failure manifests in three critical ways:

- Negative Real Returns: When inflation outpaces the nominal return of a portfolio, an investor’s purchasing power declines. A portfolio returning 5% in a 7% inflation environment is generating a real return of -2%. For a retiree with a £2 million portfolio, this represents a £40,000 annual loss in real-world spending ability.

- Failure of Diversification: The traditional role of government bonds is to rise in value when equities fall (a “flight to safety”). In an inflation-driven downturn, rising interest rates punish both asset classes. This correlated risk leaves investors with nowhere to hide, increasing overall portfolio volatility and drawdown risk.

- Inadequate Asset Allocation: Standard portfolios are often underweight or have zero allocation to asset classes that historically perform well during inflationary periods. These include commodities, infrastructure, real estate, and inflation-linked bonds. This lack of inflation-beta leaves portfolios dangerously exposed.

The consequence is not just suboptimal performance but a fundamental risk to achieving long-term financial goals, such as funding retirement, preserving generational wealth, or meeting institutional liabilities.

4. Solution Overview: The Dynamic Inflation-Resilient (DIR) Framework

To solve this, Summit Wealth Advisors has developed the Dynamic Inflation-Resilient (DIR) Framework. This is not a static product but a comprehensive, adaptive investment methodology. It is built on four core pillars designed to work in concert to deliver all-weather performance.

Pillar 1: Real Assets: Strategic allocation to assets with intrinsic physical value that tends to appreciate with inflation.

- Examples: Infrastructure (airports, utilities), real estate (logistics, residential), and commodities (via ETFs or futures).

- Function: Provides a direct hedge against rising prices and a source of inflation-linked income.

Pillar 2: Inflation-Linked Securities: A sophisticated approach to fixed income that goes beyond conventional bonds.

- Examples: U.K. Index-Linked Gilts (Linkers), U.S. Treasury Inflation-Protected Securities (TIPS), and inflation-linked corporate bonds.

- Function: Principal and coupon payments adjust with inflation, explicitly protecting the real value of the bond allocation.

Pillar 3: Quality & Pricing Power Equities: A discerning equity selection process focused on companies resilient to economic headwinds.

- Criteria: Strong balance sheets, high return on equity, sustainable dividends, and the ability to pass on rising costs to consumers (pricing power).

- Function: Moves away from speculative growth to focus on durable, cash-generative businesses that can thrive in an inflationary environment.

Pillar 4: Alternative & Uncorrelated Strategies: Incorporating strategies with low correlation to traditional equity and bond markets.

- Examples: Private credit, absolute return funds, and select hedge fund strategies.

- Function: Enhances diversification and reduces overall portfolio volatility, providing a source of returns independent of broad market direction.

Page 5: Our Analytical Methodology & Client Value Proposition

5. Our Analytical Methodology: The Engine Behind the Framework

The DIR Framework is powered by a robust, multi-layered analytical process that combines quantitative rigour with qualitative, forward-looking judgment. This is not a “black box” system but a transparent methodology.

System Flow:

- Macroeconomic Data Ingestion: We continuously monitor leading economic indicators, including ONS inflation data, Bank of England policy statements, labour market statistics, and global commodity prices.

- Quantitative Modelling: Our proprietary models analyse cross-asset correlations, real yield curves, and inflation breakeven rates. This data-driven layer identifies shifts in market regimes and signals when tactical allocation adjustments are necessary.

- Qualitative Overlay: Our investment committee applies a layer of human expertise, assessing geopolitical risks, regulatory changes, and long-term secular trends (e.g., decarbonisation, digitalisation) that quantitative models may miss.

- Strategy Implementation & Risk Management: Based on this synthesis, we implement tactical tilts within the four pillars of the DIR Framework. We employ stringent risk management protocols, including scenario analysis and stress testing, to ensure portfolio resilience.

Security & Compliance:

As a firm regulated by the Financial Conduct Authority (FCA), Summit Wealth Advisors adheres to the highest standards of professional conduct and client protection. All client data is managed in compliance with U.K. GDPR, and our operational infrastructure is built with robust cybersecurity protocols to ensure client confidentiality and asset security.

6. Client Value Proposition & Engagement Model

Our value is not simply in providing access to different asset classes, but in constructing a cohesive, bespoke strategy that delivers tangible outcomes.

Key Client Benefits:

- Preservation of Purchasing Power: Our primary goal is to ensure your wealth grows in real, after-inflation terms.

- Reduced Portfolio Volatility: By incorporating genuinely uncorrelated assets, we aim to smooth returns and mitigate the impact of severe market drawdowns.

- Access to Institutional-Grade Opportunities: We provide clients with access to asset classes and strategies (like private credit and infrastructure) that are typically unavailable to standard investors.

- Clarity and Confidence: Our transparent, data-driven process gives clients a clear understanding of how their portfolio is positioned and why, providing peace of mind in uncertain times.

Engagement Model:

We operate on a bespoke advisory and discretionary management basis. Our process begins with a deep-dive consultation to understand your unique financial objectives, risk tolerance, and time horizon. We then construct a portfolio based on the DIR Framework, tailored specifically to you. This is a partnership, supported by regular reporting, performance reviews, and direct access to your advisory team. Our fees are transparent and typically based on a percentage of assets under management (AUM).

Page 6: Use Cases & Conclusion

7. Use Cases: The DIR Framework in Action

Use Case 1: The Pre-Retiree (Client approaching retirement in 5-7 years)

- Challenge: A £3 million portfolio heavily weighted in a traditional 60/40 model. The client is concerned about a market downturn eroding their capital just before they need to start drawing an income.

- DIR Framework Application: We tactically reduce exposure to long-duration government bonds and growth-oriented equities. We increase allocation to short-duration inflation-linked gilts to protect capital in real terms. We add an allocation to global infrastructure funds, which provide stable, inflation-linked dividend income to supplement their future pension. The result is a de-risked portfolio with a more reliable income stream, insulated from inflation shocks.

Use Case 2: The Family Office (Managing intergenerational wealth)

- Challenge: A multi-generational mandate to grow the family’s capital base above inflation over a 20+ year horizon. The existing portfolio’s returns have failed to keep pace with the high inflation of the last 24 months.

- DIR Framework Application: We maintain a strategic allocation to global quality-dividend equities but complement it with an allocation to private credit, which offers high, floating-rate income streams uncorrelated to public markets. A portion of the portfolio is invested in commodities and real assets as a long-term strategic inflation hedge. This structure is designed to capture growth while building in robust, structural protection against long-term inflationary pressures.

8. Conclusion: Building a Resilient Future

The economic landscape has changed, and so must the approach to wealth management. Relying on the outdated 60/40 model in an era of structurally higher inflation is a passive acceptance of real-term wealth erosion.

The Dynamic Inflation-Resilient (DIR) Framework from Summit Wealth Advisors offers a proactive, intelligent, and data-driven alternative. By strategically combining real assets, inflation-linked securities, quality equities, and alternative strategies, we build portfolios designed not just to survive inflation, but to thrive in spite of it. We provide the expertise and sophisticated framework necessary to navigate this new era with confidence.

To understand how the DIR Framework can be applied to your portfolio, we invite you to schedule a complimentary, no-obligation portfolio review with one of our senior advisors.

Contact Us:

[Website Link] | [Email Address] | [Phone Number]

9. References

- Bank of England. (2023). Monetary Policy Reports and Minutes.

- Office for National Statistics (ONS). (2023). Consumer price inflation, UK.

- Office for Budget Responsibility (OBR). (2023). Economic and fiscal outlook.

- Bloomberg Finance L.P. (2023). Market Data for FTSE 250 and U.K. Gilt Indices.